We invest in a wide range of industrial products and services.

We look for companies with highly engineered, value-added products or services that are difficult to replicate with a clear, ROI-based value proposition and are led by outstanding management teams.

Specialty Distribution

Our specialty distribution practice seeks to invest in a wide range of distribution models where there is a clear, value-add solution provided to both suppliers and customers in a logistically complex supply chain. Ideal companies will provide a technical solution powered by sales and customer service, an ease to transacting, a tech-enabled digital / e-commerce offering, and are driven by data-informed decision making that results in a strong ROIC.

Sub-sectors of particular interest include:

- Aftermarket parts and accessories

- Engineered components (industrial and commercial automation and access controls)

- Power transmission, flow, process, motion control, test and instrumentation

- Tools and supplies for specialty professional contractors (light equipment, consumable products)

Company attributes we look for:

Identifiable source of differentiation

Deep product assortments in focused categories

Highly knowledgeable, technical sales force

Robust use of data to drive efficiencies and customer relationships

Strong market share in a fragmented niche

Opportunity to drive value via complementary acquisitions

Gross margins > 30% and/or EBITDA margins >10%

High returns on invested capital

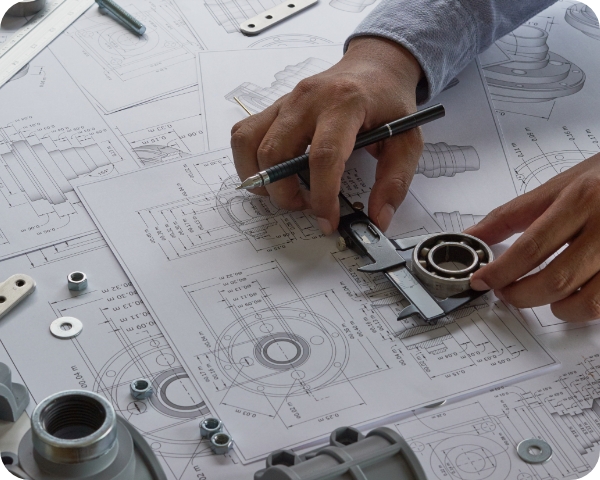

Engineered Products

Our Engineered Products practice seeks to invest in a wide range of products with a B2B and B2G (Government) customer base. Ideal companies will provide highly engineered, mission critical products that are difficult to replicate (knowhow or IP), a clear ROI for their customers, and maintain outstanding teams.

Product categories, or end markets, of particular interest include:

- Aerospace and Defense

- Engineered or proprietary components, OEM replacement parts

- Flow, process, motion and automation controls

- Advanced building products

Company attributes we look for:

Defensible market positions in growing niches

Product performance more important than price

Intellectual property: patents, trade secrets or know-how

High degree of engineering content in the product

Gross margins above 30% and EBITDA margins above 10%

Capital efficient business model

Industrial Services

Our Industrial Services practice seeks to invest in a wide range of service-focused businesses with a B2B and B2G (Government) customer base. Ideal companies will provide specialized capabilities that serve a critical purpose and provide a clear ROI for customers, a history of recurring and/or re-occurring revenues and maintain outstanding teams.

Verticals of particular interest include:

- Infrastructure services (e.g., transmission and distribution, power generation, water and wastewater, transportation infrastructure, telecommunications)

- Facility services (e.g., electrical mechanical contractors, HVACR and plumbing contractors, specialty MRO contractors)

- Environmental services (e.g., EH&S compliance, remediation services, hazardous waste disposal, resource recovery)

- Other specialty industrial services (e.g., testing, inspection, certification & compliance, and MRO)

Company attributes we look for:

Serves a critical function and/or has a high cost of non-performance

Specialized labor force with difficult-to-replicate capabilities

High level of recurring and/or re-occurring revenue

Scalable business model with opportunity, for complementary acquisitions

Gross margins >25% and EBITDA margins >10%.

Capital efficient business model