We invest in companies that provide software to niche vertical markets.

These companies have a deep understanding of their customers’ unique needs and an offering that is difficult for competitors to replicate.

Technology

Throughout its history, the Stephens family has always invested opportunistically in technology, including as early as the 1940s in various telephone style investments. Today, more than 75 years after the first technology investment, vertical software is a key investment focus for the firm.

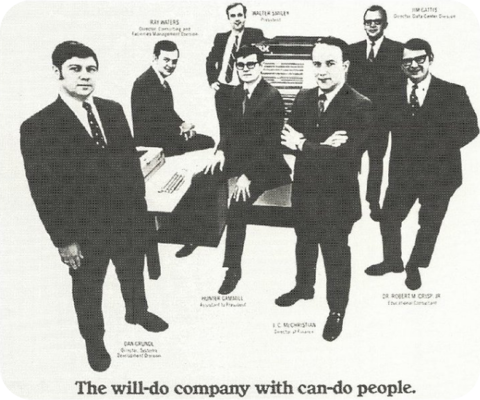

1968

Backed Walter Smiley to create Systematics, a core bank data / processing engine that still makes up most of publicly traded FIS’s bank core business.

1990

Doubled down on TMT via Alltel, when Alltel acquired Systematics and Stephens becomes one of its largest shareholders.

2003

The Stephens Group invests in SmartSignal which was sold to General Electric in 2011.

2007

Sold Alltel to TPG and Goldman Sachs for $27.5B, one of the largest buyouts in history at that time.

2016

The Stephens Group invests in CS Disco, Inc. which IPO’d on the NYSE in 2021.

2020

Through its affiliation with WestCap Group, LLC, The Stephens Group invest in StubHub/Viagogo, the world’s leading marketplace for live event ticketing and Goodleap, a market leading point-of-sale platform for financing sustainable home solutions.

2021

The Stephens Group and Princeton TMX complete a significant strategic transaction designed to accelerate the value Princeton TMX delivers to industrial shippers.

2023-2024

Stephens Group makes six investments across ed tech, freightech, industrial tech, and insurtech, solidifiying its position as a leading middle-market software investor.

End markets of particular interest include:

EdTech

FreightTech

GovTech

InsurTech

Company attributes we look for:

Products and services that are highly tailored to a unique end-market

Deep integration into the customers’ ongoing business operations

Strong unit economics

Innovative and efficient means for growing existing customers and attracting new ones

Intuitive, customer-driven product or service development pipeline

Capital efficient business model

Investment Criteria:

Interested in both majority recapitalizations and minority growth investments

Buyout Check Size

$50 – $150 Million

Growth Equity Check Size

$5 – $50 Million

- $5 Million+ ARR

- Strong Gross and Net Retention

- 70%+ Gross Margins

- Sustainable and Efficient Unit Economics

- Highly Capital Efficient